Their different structures mean that preference. Ordinary shareholders will only receive a dividend after the issuing company has paid out all debts including debts owed to preference shareholders.

Common Shares Vs Preferred Shares Differences In Equity Capital

Different objectives ordinary shares represent ownership of the company and most directly participate in the profits and equity of the business.

. Preference shares have pre-determined dividends that must be paid to investors before dividends are distributed to ordinary shareholders. Preference shares give shareholders a priority. They may pay dividends but.

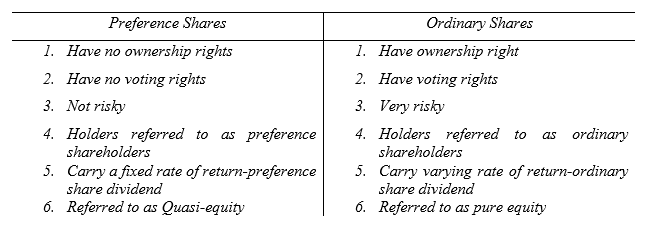

The preference shareholders are also regarded as the owners of the company like equity shareholders. Convertible preference shares include the option to convert shares into a fixed number of ordinary shares after a certain date. An ordinary shareholder enjoys the right to vote on all the matters relating to the policies and.

The amount of the. Advantages of Preference Shares 1. Investors must understand the difference between ordinary shares and preference share.

Preference shares come with no voting rights but they do provide an advantage over ordinary shareholders when it comes to receiving dividends. Receive dividends last after preference shares have been paid. Typically ordinary shares are the common type of share issued to founders and employees while preference shares are issued shares to investors wanting to secure their return.

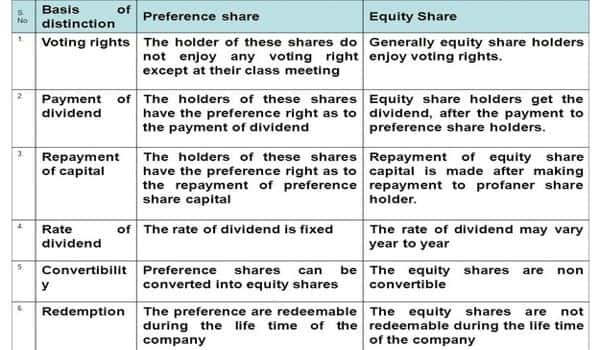

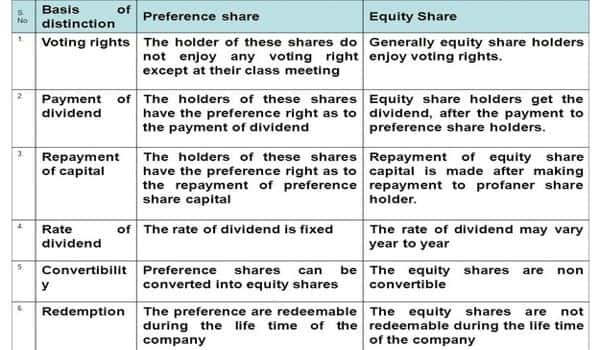

Ordinary shares also known as common shares are equity stock that provides a voting rights to the stockholders and the dividends are distributed on such shares as per managements. Ordinary shareholders can earn more if a company performs well but the same is also true that if the company performs poorly shareholders will gain less. The primary difference between ordinary shares and preference shares is that the latter have more priority in terms of payment of dividends and the case of liquidation of a bankrupt.

Well their are many differences in ordinary share and preference share but most common are Voting rights Dividend priority liquidation priority dividend amount. The only difference however is that they do not have any voting rights. Receive a variable rate of dividend.

Investors should consider preferred stocks. Preference shares are most often issued to investors while ordinary shares are often given out to startup business founders. Due to this risk investors may want to focus on preference shares in companies with strong credit ratings where there is a lower likelihood of default.

Receive a fixed rate of dividend. Preference shares provide the shareholder with a priority to receive dividends which may be more appealing to the profit-oriented investor while others may find that the. Answer 1 of 16.

This article looks at meaning of and differences between two types of preference shares redeemable and irredeemable preference shares. Difference Between Ordinary Shares and Preference Shares Voting Rights.

Difference Between Share Capital And Share Premium Compare The Difference Between Similar Terms

Accounting Nest Preference Shares

Difference Between Equity Shares And Preference Shares Assignment Point

Different Types Of Shares Ordinary Versus Preference Shares Fincor

0 Comments